Financing Montana Business

Big Sky Finance is a statewide certified development company licensed by the SBA to administer the SBA 504 Loan program in Montana. The SBA 504 Loan program is designed to provide long-term, below-market, fixed asset financing to small, for-profit businesses. The SBA 504 Loan program represents permanent financing and is an economic development program utilizing job creation.

We are here to partner with commercial lenders to provide the best long-term financing tool available to Small Business owners for their real estate and/or equipment financing needs. Leave the SBA paperwork to us – working together, we will make the process simple for you, so you are able to stay focused on serving your customers!

504 Loan Calculator

Enter your project cost and loan rates to determine your estimated monthly payments.

Current Rates

For SBA 504 Loans

Download Forms

Let us partner with you on financing

About the SBA 504 Loan Program

Big Sky Finance is here to partner with our lenders in order to provide the best long-term financing tool available to Small Business owners for their real estate and/or equipment financing needs. Leave the SBA paperwork to us – working together, we will make the process simple for you, so you are able to stay focused on serving your customers!

Big Sky Finance is a statewide certified development company licensed by the SBA to administer the SBA 504 Loan program in Montana. The SBA 504 Loan program is a direct SBA lending program designed to provide long-term, below-market, fixed asset financing to small, for-profit businesses. The SBA 504 Loan program represents permanent financing and is an economic development program utilizing job creation.

Eligible Uses

- Purchase land and improvements (operating company must occupy 60% of new buildings and 51% of existing buildings.)

- Construction of new facilities, or modernizing, renovating, or converting existing facilities.

- Refinancing of existing debt in some circumstances.

- Machinery and equipment with a minimum useful life of 10 years.

- Soft costs including but not limited to, title searches, appraisals, environment reports, architect fees, interim loan interest, certain bank fees, furniture and fixtures.

Ineligible Uses

- Inventory

- Working capital

- Intangibles

Small Business Defined As

Tangible Net worth of not more than $15 million and 2-Year average Net Income after taxes less than $5 million.

Economic Development Requirements

- Job creation or retention (one job per every $90,000 borrowed from SBA 504), OR

- Public policy or community development goals met (various options available).

- Manufacturing firm (one job per every $140,000 borrowed from SBA 504)

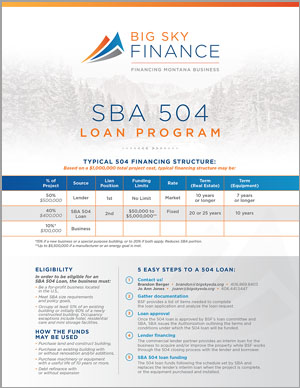

Rates and Terms

- SBA rate fixed for the term of the loan (20- and 25-year rates are tied to the 10-year Treasury bond rate).

- The private lender sets their own rates and fees (commercially reasonable).

- Loan terms are 10, 20, or 25 years (Real Estate: 10-, 20-, or 25-year note, Equipment only: 10-year note).

Fees and Payments

- All SBA 504 loan fees are added to the loan amount and amortized over the loan term. One time processing fee of approx. 2.15% of SBA’s portions, loan closing fees of approx. $2500

- On-going service fee included in the effective full-term rate.

- 10-year prepayment premium on SBA note (20 and 25-year notes)—declining prepayment scale.

Example Of Financing On A Typical $1 Million Project

Total Project Cost:

| Acquisition of Land & Building | $800,000 |

| Improvements | $180,000 |

| Soft costs (appraisal, architect, engineering, closing costs) | $20,000 |

| Total | $1,000,000 |

Project Financing:

| Entity | Loan Amount | % of Project | Security |

|---|---|---|---|

| Bank | $500,000 | 50% | 1st Lien |

| CDC/SBA 504 Loan | $400,000 | 40% | 2nd Lien |

| Borrower down payment* | $100,000 | 10%* | |

| Total | $1,000,000 | 100% |

* Start-up OR Special Purpose Building (i.e. car wash, hotel) requires 15% equity. Start-up AND Special Purpose Building requires 20% equity. Borrower down payment can be in the form of: cash, land equity, seller carry-back note (term must match SBA term and be subordinated to SBA if secured by project RE), or any combination thereof.

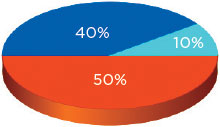

Typical Deal Structure For An Existing Business Would Be:

- 10% Owner Equity

- 50% Lender Financing (senior position on collateral)

- 40% SBA Financing (junior position on collateral)

Additional equity of 5% or 10% may be required—new business or special property.

504 Process

|

1

|

Contact us!

|

|

2

|

Gather documentationBSF will provide a list of items needed to complete the loan application and analyze the loan request. |

|

3

|

Loan approvalOnce the 504 loan is approved by BSF’s loan committee and SBA, SBA will issue a written agreement that outlines the terms and conditions under which the 504 loan can be funded. |

|

4

|

Lender financingThe lender provides a permanent loan and an interim loan for the business to acquire and/or improve the property while BSF works through the 504 closing process with the lender and business. |

|

5

|

SBA 504 loan fundingThe 504 loan will fund following the schedule set by SBA and will replace the lender’s interim loan when the project is complete or the equipment purchased. |

Testimonials

Kat Healy Red Oxx Manufacturing, Billings

Weston Fricke Simms Fishing Products, Bozeman

Kevin Gustainis, President Montana Peterbilt, Billings

Laura Johnson, Owner The Firehouse Gym, Big Timber

Jeff Johnson, Owner The Firehouse Gym, Big Timber

Funded Projects

Caring Hands Veterinary Hospital

Learn More

406 Window Co. – Billings

Learn More

Cucina Florabella – Missoula

Learn More

Buggy Bath Car Wash – Billings

Learn More

Meadowlark Brewing – Billings

Learn More

J/fit.com, LLC – Whitefish

Learn More

Mint Dental Studio – Bozeman

Learn More

Snyder Motors, Inc. – Bozeman

Learn More

Broadwater Self Storage, Inc. – Billings

Learn More

Backcountry Burger Bar – Bozeman

Learn More

Alpha Omega Disaster Restoration, Inc. – Billings

Learn More

Mountain Hot Tub – Bozeman, MT

Learn More

Daniels Gourmet Meats & Sausages – Bozeman, MT

Learn More

Nelson’s Ace Hardware – Whitefish

Learn More